Recruitment Events

Upcoming Ask Us Anything Info sessions

- Watch on-demand | RSVP

Have questions or want to chat about MPAcc?

- Click here to chat with an advisor

- Click here to book an advising appointment

About Our Program

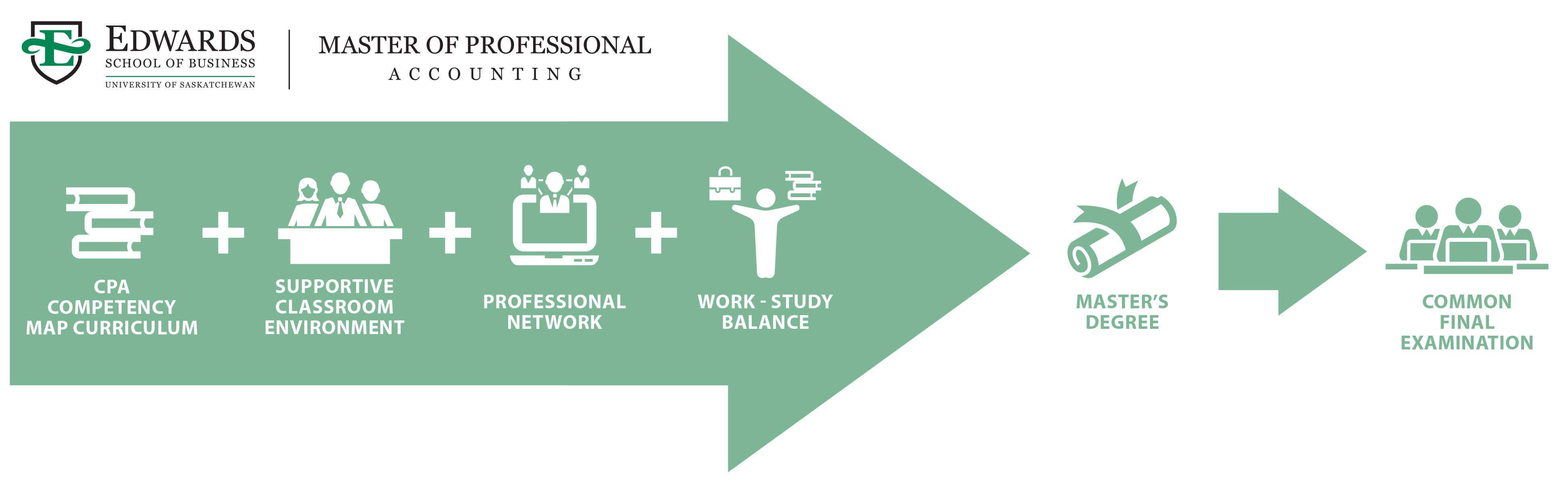

The Master of Professional Accounting Program (MPAcc) is an innovative graduate degree program that attracts top-notch accounting students from across Canada. Created by visionary academics in response to the demand for applied, competency-based training, the program actively involves students through the use of business cases, skills workshops, and other contemporary educational techniques.

Over the course of two spring-summer terms, you will complete a comprehensive graduate level accounting program that acts as a proven alternative route for students who are seeking the CPA designation in Canada. We are proud to have a strong history of first time pass rates from our MPAcc graduates on the Common Final Evaluation (CFE). The program also gives students an opportunity to develop an appreciation for the academic research process and academia as a career choice.

Students enrolled in the MPAcc program undertake an alternative course-based route that covers all modules of the CPA PEP program. Upon completion of the MPAcc program, you may go on to write the Common Final Examination in the fall.

Megan Evans shares her experience as an MPAcc student at Edwards School of Business. Read more here.

"Because of the Edwards MPAcc program, I grew my connections with individuals from all around Canada. The learning is very in-depth and provides many applications to the actual work I perform now every day." - Hardip, MPAcc 2022

Course Details

The Edwards MPAcc program is completed through full-time, in-person study. Students take 6 courses per Spring/Summer term. Two courses are taken at a time, for a during of 4-6 weeks within the term. There are no courses delivered in the Fall or Winter terms, allowing students to prioritize employment and obtaining practical experience required for the CPA designation. This intensive and comprehensive format provides a strong foundation of technical and professional skills for future CPAs.

-

Year One

MPAC 831 Strategy & Governance

The course provides you with a hands-on opportunity to develop the competencies needed to formulate a risk management plan and strategy for an organization, as well as to evaluate and improve its governance.

MPAC 833 Financial Reporting & Analysis

This course will review selected topics from the undergraduate Corporate Finance course and build upon that knowledge. This is accomplished through a deeper and richer consideration of a variety of approaches to financial valuation including discounted cash flow, earnings, and the residual income models. A secondary goal of this course is to develop skills appropriate for an entry level professional at exercising professional judgment and addressing client concerns.

MPAC 835 Assurance

This course aims to develop knowledge of financial statement auditing concepts and practices, enhance critical thinking and analytical skills to support decision making, and develop awareness of relevant auditing issues and future developments in the field, and develop other relevant knowledge, behaviour, and skills.

MPAC 837 Advanced Finance

Using the framework of financial valuation as an organizing tool, key topics from corporate finance will be discussed including risk, return, capital-budgeting, capital structure and payout policy and valuation under leverage. Alternative approaches to valuation, real and financial options financial forecasting and models are also considered.

MPAC 839 Advanced Taxation

This course examines many of the tax issues, problems and planning opportunities professional accountants encounter in providing tax services to taxpayers. Students are challenged to gain a deeper understanding of the purpose of specific rules in the Canadian system and to think critically about the issues faced by policymakers.

MPAC 992 Research Project

This course provides an opportunity to develop insights into, and an appreciation for, the academic research process. During the course you will examine a number of academic research papers and engage in various research design exercises. You will also take part in an accounting research conference featuring invited academics from other programs. You will demonstrate your learning through a combination of written submissions, discussions with the instructor, formal presentations and a final exam.

*For the most up-to-date program information visit the USask Course and Program Catalogue.

-

Year Two

MPAC 851 Advanced Management Accounting

This course introduces you to the vital role that modern management accounting information plays in running a business in today’s economy in the context of performance management. The course pays particular attention to the competency maps of all accounting professions with a view for the future CPA designation. To ensure coverage of the competencies, technical aspects of management accounting are emphasized and tested in this course. However, we will also cover a strategic perspective to management accounting. In the end, you can be assured that the critical aspects of management accounting will be emphasized to prepare you for your future accounting and career requirements.

MPAC 853 Advanced Financial Reporting

This course is designed to provide mastery of additional accounting concepts, apply your knowledge in a wide variety of circumstances, and further develop the skills required of professional accountants.

Emphasis in this course will be placed on integrating your understanding of GAAP principles. While the focus is largely on profit-oriented firms, an understanding of GAAP for not-for-profit and government organizations will be developed. The combination of MPAC 833 and MPAC 853 is intended to meet, and exceed, all Financial Accounting and Reporting objectives in the CPA Competency Map.

MPAC 855 Advanced Assurance

This course examines the provision of assurance in modern business, government, and not-for-profit organizations. You will be introduced to several areas in which assurance is provided, and study in detail financial statement audit and review engagements. You also will study the provision of related professional services, which are not designed to provide a specific level of assurance.

In this course you will:

- Develop knowledge of assurance concepts and practices relevant to the selected course topics

- Apply auditing concepts to novel situations (gain an understanding of auditing anything!)

- Enhance critical thinking and development of refined analytical skills to support decision making

- Develop professional skills

MPAC 858 Advanced Financial Planning

Using the frameworks of tools learned in MPAC 837 and MPAC 839 and undergraduate finance and taxation courses, this course will discuss key topics in financial planning which integrates finance and tax issues. Alternative approaches to valuations, financial forecasting for decision-making, personal and corporate tax planning will be reviewed using case analysis

MPAC 891 Integrative Capstone 1

This course will provide the context for day 1 of the Chartered Professional Accountants National Common Final Exam. The course will integrate content from Performance Management, Finance, Tax, Assurance, and Financial Reporting using a variety of cases and simulations.

Through this course, you will be able to:

- Analyze large integrated business problems

- Demonstrate critical thinking skills

- Make informed decisions

- Communicate results of analyses including assumptions made and decisions reached: orally and in written format

- Work effectively in a team environment

MPAC 892 Integrative Capstone 2

This course provides the context for all three days of the of the Chartered Professional Accountants national Common Final Exam. You will have the opportunity to hone your case writing skills, receive customized feedback and further develop critical thinking and assessment skills; all while in a supportive classroom environment.

*For the most up-to-date program information visit the USask Course and Program Catalogue.

Application Deadline

2026 MPAcc program applications are now open.

Applications and all supporting documents for the Spring 2026 intake must be submitted by November 30, 2025.

International Applicants: The MPAcc program is 4 months full-time within a calendar year. This study period may not meet study visa requirements. It is highly recommended that you speak with an immigration advisor regarding Study Permits and MPAcc before applying.

Admission Requirements

-

Application Process

The Edwards MPAcc Admission Committee assesses applicants on a composite basis for admission purposes. We look at a variety of factors including undergraduate degree, grade point average, experience in the accounting field, and reference letters to assess an applicant’s suitability for full-time graduate-level studies. An interview may be required. Applicants are competitively assessed within the applicant pool for the year they are applying to.

Your Completed Admission Package Includes:

- Completed Online Application Form and Application Fee

- Unofficial Transcripts from all Post-secondary Institutions you have attended

- Supplemental Application Form

- Three Letters of Reference

- Current Resume

- English Proficiency Scores (if required)

- CPAWSB Transcript Assessment (if required)

Please review the sections below for further instruction on these items.

All documents must be uploaded to your online application. Once an application form and application fee has been received, an automated email will be sent within 48 hours with login information for uploading your documents.

Applications will not be reviewed until all required documents, including letters of reference, are received. -

Academic Requirements & Prerequisite Courses

Applicants must have a four-year undergraduate degree from a recognized university. Applicants must demonstrate their ability to pursue advanced study with a minimum 70% overall average in the last two years of undergraduate studies.

All applicants must demonstrate adequate preparation in Canadian Accounting principles as demonstrated by successful completion of the appropriate university-level prerequisite courses (listed below). Material covered in MPAcc requires an in-depth knowledge of Canadian Tax and Canadian Accounting Standards, which have been obtained from a recognized Canadian institution (college or university). This requirement will not be waived based on study of these topics in other countries.

These pre-requisite courses are designated by the Canadian Institute of Chartered Professional Accountants for entrance into their Professional Education Program.Applicants who have completed their undergraduate studies outside of Canada must have their international transcripts assessed by CPAWSB to determine if their courses are recognized as equivalent to the Canadian requirements and therefore fulfill the prerequisites. Please review the CPAWSB Transcript Assessment section for further instruction.

CPA Preparatory Course Topics

University of Saskatchewan Courses

Introductory Financial Accounting

COMM 201

Introductory Management Accounting

COMM 210

Economics

ECON 114

Statistics

COMM 104

Business Law

COMM 304

Information Technology

COMM 337

Intermediate Financial Reporting 1

COMM 321

Intermediate Financial Reporting 2

COMM 323

Advanced Financial Reporting

COMM 433

Corporate Finance

COMM 203 + COMM 363

Audit and Assurance

COMM 414 + COMM 421

Taxation

COMM 405 or (COMM 406 + COMM 407)

Intermediate Management Accounting

COMM 308 + COMM 438

Performance Management

COMM 401 + COMM 438

Data Analytics & Information Systems (DAIS)

COMM 324

For a detailed list of applicable courses by province and post-secondary institution, please refer to the academic prerequisites guide on the CPAWSB website. -

Post-Secondary Transcripts

Unofficial transcripts from all post-secondary institutions that you have attended must be uploaded to your application. For completed programs where a degree/diploma certificate was issued, an unofficial copy of the certificate must be uploaded to the online application as well.

If accepted, an official transcript of your academic record is to be sent directly from each institution attended.

Applicants who have completed their undergraduate studies outside of Canada must upload a CPAWSB transcript assessment along with all unofficial transcripts. See details in the relevant section below. The University of Saskatchewan does not accept WES documents for applications/admission in place of transcripts or the CPAWSB assessment.

-

Supplemental Application Form

The Supplemental Application Form is used to obtain additional information on which courses you have completed and what work experience you have or plan on obtaining before MPAcc begins. Download it here.

-

Letters of Reference

Applicants are required to have 3 confidential letters of recommendation submitted in support of their application to MPAcc. Your letters of reference should come from professors or others acquainted sufficiently with your training and experience to express an opinion on your ability to undertake graduate studies. Two of these must be academic references and one professional.

- Contact your referees and ask them to provide a reference for you for the Edwards MPAcc program and obtain an up-to-date email address.

- You will then fill out your referees’ complete information, including their current email address, on the online application form.

- Once your application is completed, your referees will be sent a link where they can fill out an online form for your reference letter.

-

Resume/CV

Outline your previous work education and work experience (if applicable) so the Admission Committee can have a good understanding of your background.

Students who have at least four months of work experience as an articling student or in a similar position will be given preference. Work experience provides a practical framework that enhances the student's ability to understand and critically assess the subject matter considered in the MPAcc program. -

Proof of English Proficiency

Proof of English language proficiency may be required for international applicants and for applicants whose first language is not English. See the College of Graduate and Postdoctoral Studies Academic Information and Policies for more information. To see whether you will be exempt from this requirement, click here. All scores must be from one exam date, not to be combined with other exam dates. Tests are valid for 24 months after the testing date and must be valid at the beginning of the student’s first term or registration in the graduate program.

-

CPAWSB Transcript Assessment

Applicants who have completed their undergraduate studies outside of Canada, must have a transcript assessment completed by the CPA Western School of Business. The Transcript Assessment will determine if the courses taken outside of Canada are recognized as equivalent by the CPA Western School of Business, and therefore if they fulfill the pre-requisite courses required for admission to MPAcc. The resulting CPAWSB Transcript Assessment document must be uploaded to your online application as part of the completed Admission Package.

You can visit https://my.cpawsb.ca/Views/CPARegister.aspx to set up a My CPA Portal profile and request to have an international transcript assessment completed by CPAWSB. Visit www.cpawsb.ca or contact cpaapplication@cpawsb.ca for more information.

Please note that this transcript assessment process can take up to 12 to 14 weeks. Applicants with international education are encouraged to begin this process early to ensure the completed Transcript Assessment is submitted by the MPAcc application deadline.

Tuition and Financial Aid

-

Tuition & Fees

The College of Graduate and Postdoctoral Studies at the University of Saskatchewan governs tuition and fee structures for graduate programs across the university including the MPAcc program. Graduate fees are comparable to similar programs at other universities.

Tuition figures below are for 2025-2026. Domestic Students include Canadian Citizens and Permanent Residents. International master's tuition rates are 2.25 times the domestic graduate rate.

Domestic Student Tuition

International Student Tuition

$30,000 CAD

($15,000 CAD per year)

$67,500 CAD

($33,750 CAD per year)

Student Fees

All graduate students, including international graduate students, must pay student fees. These fees are subject to review and revision at any time, and, they are non-refundable after the add/drop deadline for a given term. Current fees are posted on the USask Graduate Studies tuition and fees website. For information on how and when to pay graduate fees check the University Course Calendar for Payment of Tuition and Compulsory Fees.

Cost per Year

Graduate Student Fees

$70 CAD

-

Textbooks & Computer Equipment

Estimates are about $400 per year for class textbooks. You can purchase books online, including second hand books, from the Shop USask website.

Cost per Year

Textbooks

$400.00 (approx)

Computer Equipment

Students are required to bring a PC laptop computer for MPAcc. MAC computers are not compatible with some of the software used in the MPAcc program.

-

Scholarships, Bursaries, & Awards

The Edwards School of Business MPAcc Office administers scholarships and bursaries for both incoming and continuing students. Approximately $90,000 is distributed to MPAcc students annually. Awards have specific criteria based on academic achievement and financial need; and range in value up to $10,000. Application periods, deadlines, eligibility requirements, and payout dates are posted annually for students in the first month of the MPAcc program.

Edwards has a dedicated award for First Nation, Métis, and Inuit graduate students:

- Dean’s Circle awards (three awards valued at $10,000 each) recognize Indigenous graduate students who are entering or continuing a master’s program (Master of Business Administration, Master of Professional Accounting, or Master of Science) at Edwards. The award will be given out in the 2025 academic year to students who have verified their Indigenous citizenship/membership based on the University of Saskatchewan’s deybwewin | taapwaywin | tapwewin policy.

For more information on other graduate student scholarships, please visit Award Search.

Approximately $90,000 is distributed to MPAcc students annually. Awards have specific criteria based on academic achievement and financial need; and range in value up to $10,000.

Ready to Study With Us?

If you would like more information on the Master of Professional Accounting, please contact us:

MPAcc Program Office

Edwards School of Business

University of Saskatchewan

Room 241, 25 Campus Drive

Saskatoon, Saskatchewan, Canada

S7N 5A7